To find the best company is important to compare auto insurance rates by vehicle. It can help to save some dollars on something you’re most needed. However, most insurers may consider the same factors to determine pricing.

It’s like they have their own “secret sauce” when charging the rates. As a result, two companies can be subject to different rates for the same driver. So, the type of your vehicle is one of the most crucial factors in setting your vehicle insurance rates.

Furthermore, rates depending on the car’s type are less about risk level and more about how much it’ll cost to repair or replace the car. It includes car types like sports-utility vehicles, motorcycles, recreational vehicles, and campers.

In our article, we’ll help you to compare auto insurance rates by vehicle. So keep reading more to find out!

How Can Vehicle Types Affect Insurance Rates?

The vehicle type, make, model, and trim directly affects the cost of your car insurance. It is basically because the insurers use this information to decide the vehicle’s worth, safety features, and how much it costs to repair. For instance, the luxury car model will cost higher to repair compared to a standard car model.

In addition, the higher repair cost can result in higher premiums. Here are several factors on vehicles that determine the price:

1. Vehicle MSRP

More expensive vehicles usually cost higher to repair because of custom, foreign or premium parts. It’s generally caused by higher auto insurance rates. Furthermore, you’ll also require higher coverage maximums to cover claims, indicating you need to be charged more for coverage.

2. Theft Possibility Rates

Insurance is not only covering the crash accident but also claims for thieves. So, the company needs to consider the rates of the possibility of thieves for certain types of vehicles. Moreover, some vehicles, like the Chevy Impala and Honda Accord, have a high possibility of being thieves’ targets. Thus, this increases the insurance price.

3. Safety Ratings

The less possibility for cars to get into accidents will cause less cost to repair. It means fewer claims to be made on average and more savings for you. That’s why a provider must consider the safety rating of the cars to determine the cost.

4. Vehicle’s Sportiness

If you have a sportier car, it means you are more likely to drive fast. As a result, you’ll have a higher risk of getting in a collision. What’s more, convertibles are prone to have higher theft rates, since soft tops are easier to steal. Therefore, the provider will consider the sportiness of the vehicle to determine the rates.

Let’s Compare Auto Insurance Rates by Vehicle!

As we mentioned before, the vehicle’s make and model your drive is one of the most important factors insurance companies use to calculate the auto insurance cost. So, whether it’s a car, motor, truck, or anything else, knowing what your vehicle will cost is important.

In addition, learning the price can lead to savings on auto insurance quotes. The first step to getting the best deals is to compare auto insurance rates by vehicle. So here is the comparison of auto insurance rates based on the vehicles:

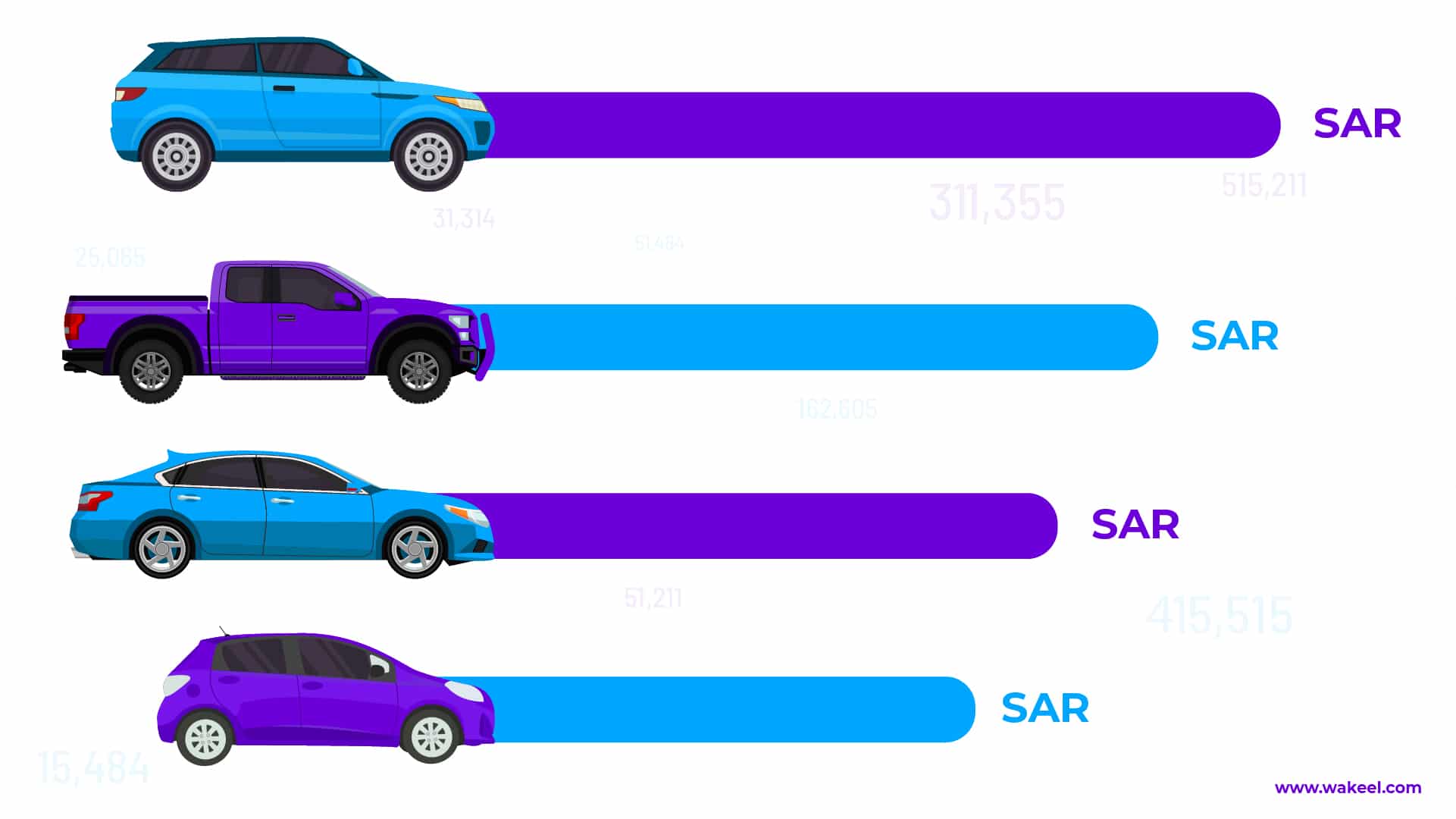

1. Pickup Trucks

The first vehicle type that comes to our list is pickup trucks. This type of car has a thing in common with other cars, which is it needs to be insured. Fortunately, we discover that trucks are the second cheapest rates among other vehicle types. It is because it has an average annual premium of $1,731.

For instance, the 2020 Chevy Colorado has an average annual premium of $1,113 with the cheapest option from USAA. Besides, the Tundra has a price of over $1,500/year.

2. SUV

SUV has a fairly broad term, so it’s pretty tricky to compare it based on make-and-model combinations. It has a wide selection of types and models from the minimal to the most luxurious ones.

In the cheapest option, we found Honda CR-V has auto insurance rates ranging from $962-$2,089. Whereas, the Jeep Grand Cherokee approximately cost $1,022-$2,109. Overall, the SUV has a standard average rate of $1,500 per year.

3. Sedans

Next is Sedans which tend to charge less to insure than hybrids and trucks. However, you can overpay your profile and your driving record doesn’t suit the current company’s policies. For the price based on the model, we found that the Chevrolet Cruze cost $106 and the Nissan Altima cost $118 monthly.

4. Minivans

When we compare auto insurance rates by vehicle, we figure out that Minivans are the cheapest auto insurance. A minivan has an average annual price of $1,329 to insure. It’s much cheaper compared to sedans with $1,700 rates and $1,500 for an SUV.

Regardless of how cheap the minivan coverage is, it’s important to compare the minivan type and providers. For instance, the Chrysler Pacifica has the cheapest monthly premiums at $1,196 and Toyota Sienna at $1,328 by Nationwide.

5. Coupes

The last vehicle type is Coupes with the cost determination that is pretty complicated. Furthermore, the coupes’ average car insurance rate can be higher than the national average of $1,470. For instance, the Audi A5 has an annual insurance rate of $1,547, and the Honda Civic of $1,045 by USAA.

Ready to Compare Vehicle for the Best Auto Insurance Rates?

Your vehicle’s make and model are the biggest factor to determine the insurance rates. But the car’s trim level also can affect the rates. Furthermore, the car’s trim level is specific to the car’s model. So, it’s very important to consider all aspects of your car model and your history to compress the auto insurance rate.

Shopping for car insurance can be pretty tricky, and comparing auto insurance rates by vehicle can help to narrow down your decision. Rates also can change drastically depending on which vehicle you drive and the driver’s history. It includes the vehicle’s MSRP, safety, thief possibility, and sportiness.

In addition, you should compare as many auto insurance companies as possible. By doing this, it can allow you to either confirm getting the best rate or discover an even better rate. Therefore, we hope our article concerning the compare auto insurance rates by vehicle can help to get the best deals!

Leave a Reply